Does Utah Have A Supplemental Tax Rate . Web if you make $70,000 a year living in utah you will be taxed $11,018. Web while the federal supplemental tax rate is a flat 22%, states have different approaches, with some imposing specific rates, others applying regular income tax. Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. Web employers may optionally use a federal flat rate of income tax federal withholding of 22% on supplemental wages up to $1 million for. You can also view current and past income. Your average tax rate is 10.94% and your marginal tax rate is 22%. Web the income tax rates and personal allowances in utah are updated annually with new tax tables published for resident and non. Web 43 rows for instance, consider if the supplemental withholding rate is significantly higher or lower than the. Web utah has a single tax rate for all income levels, as follows:

from www.pdffiller.com

Web while the federal supplemental tax rate is a flat 22%, states have different approaches, with some imposing specific rates, others applying regular income tax. You can also view current and past income. Web if you make $70,000 a year living in utah you will be taxed $11,018. Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. Web 43 rows for instance, consider if the supplemental withholding rate is significantly higher or lower than the. Web employers may optionally use a federal flat rate of income tax federal withholding of 22% on supplemental wages up to $1 million for. Your average tax rate is 10.94% and your marginal tax rate is 22%. Web the income tax rates and personal allowances in utah are updated annually with new tax tables published for resident and non. Web utah has a single tax rate for all income levels, as follows:

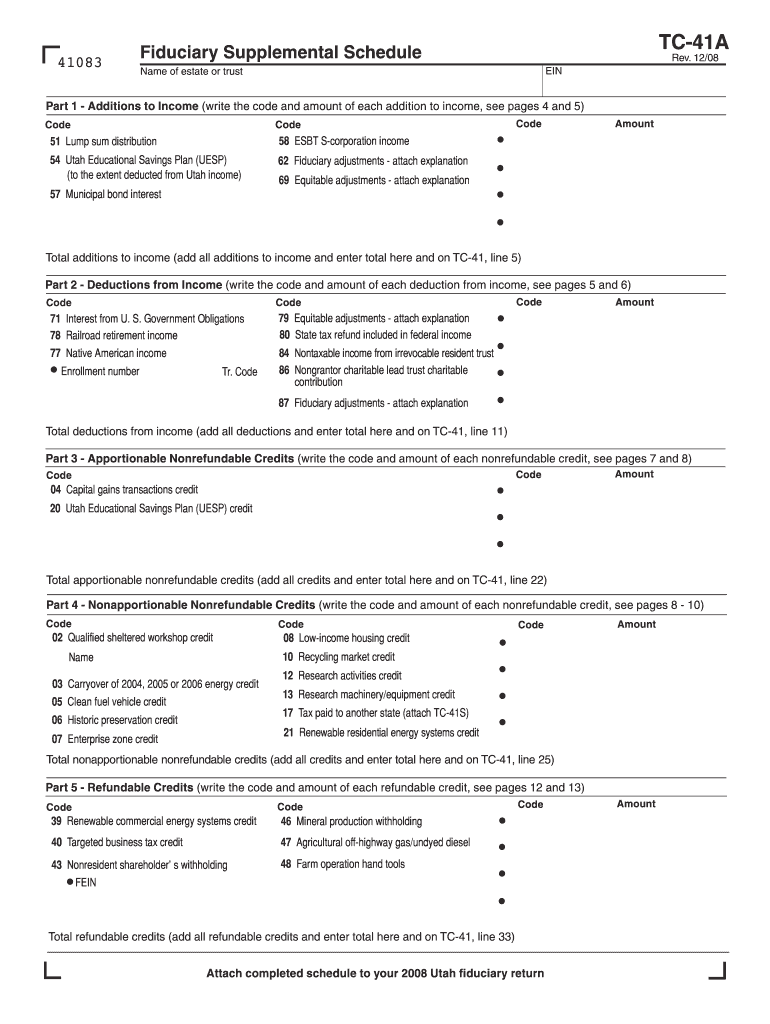

Fillable Online tax utah 2008 TC41A Supplemental Schedule Utah Fax

Does Utah Have A Supplemental Tax Rate Web 43 rows for instance, consider if the supplemental withholding rate is significantly higher or lower than the. Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. Web employers may optionally use a federal flat rate of income tax federal withholding of 22% on supplemental wages up to $1 million for. Web the income tax rates and personal allowances in utah are updated annually with new tax tables published for resident and non. Web while the federal supplemental tax rate is a flat 22%, states have different approaches, with some imposing specific rates, others applying regular income tax. You can also view current and past income. Web utah has a single tax rate for all income levels, as follows: Web if you make $70,000 a year living in utah you will be taxed $11,018. Web 43 rows for instance, consider if the supplemental withholding rate is significantly higher or lower than the. Your average tax rate is 10.94% and your marginal tax rate is 22%.

From www.utahcounty.gov

2020 Taxation Information Does Utah Have A Supplemental Tax Rate Web the income tax rates and personal allowances in utah are updated annually with new tax tables published for resident and non. Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. Your average tax rate is 10.94% and your marginal tax rate is 22%. Web utah has a single tax rate for all income. Does Utah Have A Supplemental Tax Rate.

From www.templateroller.com

Form TC40A Download Fillable PDF or Fill Online Tax Does Utah Have A Supplemental Tax Rate Web if you make $70,000 a year living in utah you will be taxed $11,018. You can also view current and past income. Web while the federal supplemental tax rate is a flat 22%, states have different approaches, with some imposing specific rates, others applying regular income tax. Web employers may optionally use a federal flat rate of income tax. Does Utah Have A Supplemental Tax Rate.

From taxfoundation.org

Utah Sales Tax A Policymakers’ Guide to Modernizing Utah’s Sales Tax Does Utah Have A Supplemental Tax Rate Web employers may optionally use a federal flat rate of income tax federal withholding of 22% on supplemental wages up to $1 million for. Web utah has a single tax rate for all income levels, as follows: Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. You can also view current and past income.. Does Utah Have A Supplemental Tax Rate.

From www.templateroller.com

Form TC40A Schedule A 2019 Fill Out, Sign Online and Download Does Utah Have A Supplemental Tax Rate Web 43 rows for instance, consider if the supplemental withholding rate is significantly higher or lower than the. Web while the federal supplemental tax rate is a flat 22%, states have different approaches, with some imposing specific rates, others applying regular income tax. Web utah has a single tax rate for all income levels, as follows: You can also view. Does Utah Have A Supplemental Tax Rate.

From www.pdffiller.com

Fillable Online tax utah 2011 TC40A, Tax Supplemental Schedule Does Utah Have A Supplemental Tax Rate Web the income tax rates and personal allowances in utah are updated annually with new tax tables published for resident and non. Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. Web employers may optionally use a federal flat rate of income tax federal withholding of 22% on supplemental wages up to $1 million. Does Utah Have A Supplemental Tax Rate.

From www.chegg.com

Solved tax (supplemental rate), a 4.95 Utah Does Utah Have A Supplemental Tax Rate Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. Your average tax rate is 10.94% and your marginal tax rate is 22%. Web 43 rows for instance, consider if the supplemental withholding rate is significantly higher or lower than the. Web the income tax rates and personal allowances in utah are updated annually with. Does Utah Have A Supplemental Tax Rate.

From www.youtube.com

Utah State Taxes Explained Your Comprehensive Guide YouTube Does Utah Have A Supplemental Tax Rate Web employers may optionally use a federal flat rate of income tax federal withholding of 22% on supplemental wages up to $1 million for. Web while the federal supplemental tax rate is a flat 22%, states have different approaches, with some imposing specific rates, others applying regular income tax. Web 43 rows for instance, consider if the supplemental withholding rate. Does Utah Have A Supplemental Tax Rate.

From www.paystubs.com

Supplemental Tax Rates by State Does Utah Have A Supplemental Tax Rate Web utah has a single tax rate for all income levels, as follows: Web the income tax rates and personal allowances in utah are updated annually with new tax tables published for resident and non. Web 43 rows for instance, consider if the supplemental withholding rate is significantly higher or lower than the. Web the tables in publication 14, withholding. Does Utah Have A Supplemental Tax Rate.

From www.mortgagerater.com

Utah Tax Rate Insights for Residents Does Utah Have A Supplemental Tax Rate Your average tax rate is 10.94% and your marginal tax rate is 22%. Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. Web if you make $70,000 a year living in utah you will be taxed $11,018. Web employers may optionally use a federal flat rate of income tax federal withholding of 22% on. Does Utah Have A Supplemental Tax Rate.

From utahtaxpayers.org

National Data on Property Taxes Shows How Valuable Utah’s Truthin Does Utah Have A Supplemental Tax Rate Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. Your average tax rate is 10.94% and your marginal tax rate is 22%. You can also view current and past income. Web utah has a single tax rate for all income levels, as follows: Web while the federal supplemental tax rate is a flat 22%,. Does Utah Have A Supplemental Tax Rate.

From www.pdffiller.com

Fillable Online tax utah 2008 TC41A Supplemental Schedule Utah Fax Does Utah Have A Supplemental Tax Rate Web if you make $70,000 a year living in utah you will be taxed $11,018. Your average tax rate is 10.94% and your marginal tax rate is 22%. Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. Web utah has a single tax rate for all income levels, as follows: Web employers may optionally. Does Utah Have A Supplemental Tax Rate.

From gingerqdonelle.pages.dev

Utah State Tax Rate 2024 Vinni Jessalin Does Utah Have A Supplemental Tax Rate Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. Web utah has a single tax rate for all income levels, as follows: Web employers may optionally use a federal flat rate of income tax federal withholding of 22% on supplemental wages up to $1 million for. Web if you make $70,000 a year living. Does Utah Have A Supplemental Tax Rate.

From taxfoundation.org

StateLocal Tax Burden Rankings Tax Foundation Does Utah Have A Supplemental Tax Rate Web 43 rows for instance, consider if the supplemental withholding rate is significantly higher or lower than the. Web if you make $70,000 a year living in utah you will be taxed $11,018. You can also view current and past income. Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. Web employers may optionally. Does Utah Have A Supplemental Tax Rate.

From www.utahfoundation.org

Utah Priorities 2020 Utah Priority No. 2 State Taxes and Spending Does Utah Have A Supplemental Tax Rate You can also view current and past income. Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. Web employers may optionally use a federal flat rate of income tax federal withholding of 22% on supplemental wages up to $1 million for. Web while the federal supplemental tax rate is a flat 22%, states have. Does Utah Have A Supplemental Tax Rate.

From entrepreneur.com

States With the Lowest Corporate Tax Rates (Infographic) Does Utah Have A Supplemental Tax Rate Web employers may optionally use a federal flat rate of income tax federal withholding of 22% on supplemental wages up to $1 million for. Web the tables in publication 14, withholding tax guide, list the current tax withholding rates. Web while the federal supplemental tax rate is a flat 22%, states have different approaches, with some imposing specific rates, others. Does Utah Have A Supplemental Tax Rate.

From emilinewmarta.pages.dev

2024 State Supplemental Tax Rates Tamar Fernande Does Utah Have A Supplemental Tax Rate Web utah has a single tax rate for all income levels, as follows: Web employers may optionally use a federal flat rate of income tax federal withholding of 22% on supplemental wages up to $1 million for. You can also view current and past income. Your average tax rate is 10.94% and your marginal tax rate is 22%. Web if. Does Utah Have A Supplemental Tax Rate.

From www.cashreview.com

State Corporate Tax Rates and Brackets for 2023 CashReview Does Utah Have A Supplemental Tax Rate Web if you make $70,000 a year living in utah you will be taxed $11,018. Web while the federal supplemental tax rate is a flat 22%, states have different approaches, with some imposing specific rates, others applying regular income tax. Web the income tax rates and personal allowances in utah are updated annually with new tax tables published for resident. Does Utah Have A Supplemental Tax Rate.

From www.patriotsoftware.com

2024 Supplemental Tax Rates By State Chart Does Utah Have A Supplemental Tax Rate Web utah has a single tax rate for all income levels, as follows: Web employers may optionally use a federal flat rate of income tax federal withholding of 22% on supplemental wages up to $1 million for. Your average tax rate is 10.94% and your marginal tax rate is 22%. Web if you make $70,000 a year living in utah. Does Utah Have A Supplemental Tax Rate.